Interpreting Health Claims Data

Assessing health care costs by individual demographic characteristics (e.g., employment status, sex, age) and organizational demographic characteristics (e.g., unit or division, multiple sites in one organization) will allow the team to identify groups of individuals or worksites with the highest health care costs, and results of those analyses can be used to identify target populations or worksites for which workplace health and safety programs should be developed to improve workplace conditions and the health and well-being of the workforce.

Categorizing each of the conditions outlined earlier based on the grid presented in Importance of Health Issues (Figure) will allow for identifying areas of most importance. Such an assessment helps prioritize conditions that a health promotion program should target or provide information for the benefits coordinator to use in making changes to benefits plans. In addition to identifying target conditions, this analysis may help identify certain behaviors that would help in preventing or delaying the development of a condition. For example, if obesity or diabetes are found to be major contributors to health care expenditures, a company should consider targeting behaviors like physical activity and a healthy diet.

Additionally, comparing prevalences of certain conditions (e.g., diabetes, hypertension, high cholesterol, or heart disease) among health plan enrollees with estimates from national databases (e.g., NHANES, NHIS, or BRFSS) will allow for identifying potential conditions that may be more prevalent in the specific company population vs. general population. Further, analyzing the conditions in terms of job type, socioeconomic status (SES), and other demographic categories may help in targeting interventions and developing policies. Socioeconomic status can provide an indicator of the percent of out-of-pocket costs for prescriptions by various employees.

Understanding codes and costs

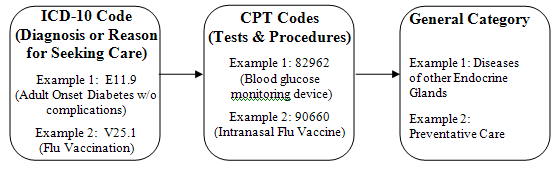

[A text description of this chart is also available.]

Understanding codes

It is important to understand the basics of medical claims in order to be aware of the source of medical costs. Medical costs impact both the employer and employee, as the employer often provides health care coverage and the employee often contributes to deductibles, premiums, and co-insurance costs. Understanding medical costs can help employers determine appropriate coverage and can also see where employees spend their own money. Analyzing employee costs may determine which services and activities are important to cover and promote, as out of pocket expenditures for an employee may limit their participation in medical services.

There are two main components of a medical claim: International Statistical Classification of Diseases currently in its 10th edition (ICD-10) and Current Procedural Terminology (CPT) Codes maintained by the American Medical Associationexternal icon. The figure above provides an explanation of ICD-10 and CPT Codes.

ICD-10 codes

ICD-10 codes explain why the person sought medical attention. Every diagnosis, disease, and condition has its own ICD-10 code. As shown in the figure above, the ICD-10 code for adult onset diabetes without complications is E11.9: if there were complications, such as blindness, then there would be a different code (E11.3). Specifications or complications of the general disease or condition (e.g., blindness associated with diabetes) build off the baseline code for the disease or condition. The ICD-10 code does not represent an expenditure or charge.

CPT codes

Each CPT code corresponds to a particular procedure, service, device or treatment. Unlike the ICD-10 codes, CPT codes translate into direct medical costs. For instance, the diagnosis of diabetes is not a billable procedure, while the glucose test to diagnose the disease is.

- Health Care Claims Analysis Sample Calculations pdf icon[PDF – 62K] provides sample calculations

- Health Care Data Information Spreadsheet excel icon[XLS – 126K] provides a health care data information spreadsheet