A Policy-Ready Public Health Guidebook of Strategies and Indicators to Promote Financial Well-Being and Address Financial Strain in Response to COVID-19

ORIGINAL RESEARCH — Volume 20 — February 23, 2023

Candace IJ Nykiforuk, PhD1; Ana Paula Belon, PhD1; Evelyne de Leeuw, PhD2,3; Patrick Harris, PhD2,3; Lisa Allen-Scott, PhD4; Kayla Atkey, MSc1; Nicole M Glenn, PhD1; Elaine Hyshka, PhD1; Karla Jaques, MPH2,3; Krystyna Kongats, PhD1; Stephanie Montesanti, PhD1; Laura M Nieuwendyk, MSc1; Roman Pabayo, PhD1; Jane Springett, PhD1; Aryati Yashadhana, PhD2,3 (View author affiliations)

Suggested citation for this article: Nykiforuk CI, Belon AP, de Leeuw E, Harris P, Allen-Scott L, Atkey K, et al. A Policy-Ready Public Health Guidebook of Strategies and Indicators to Promote Financial Well-Being and Address Financial Strain in Response to COVID-19. Prev Chronic Dis 2023;20:220209. DOI: http://dx.doi.org/10.5888/pcd20.220209.

PEER REVIEWED

What is already known on this topic?

Financial strain is associated with poor physical and mental health outcomes. Most financial strain–related programs focus on behavioral change and, therefore, produce short-term effects.

What is added by this report?

Our study introduces a guidebook of evidence-informed strategies for governments and organizations to address the determinants of financial strain. It also provides sample indicators to support assessment of policies and programs.

What are the implications for public health practice?

The guidebook offers a road map for decision makers, alone or in partnership with other actors, to design and implement sustainable initiatives for long-term financial well-being.

Abstract

Introduction

The COVID-19 pandemic has adversely affected the financial well-being of populations globally, escalating concerns about links with health care and overall well-being. Governments and organizations need to act quickly to protect population health relative to exacerbated financial strain. However, limited practice- and policy-relevant resources are available to guide action, particularly from a public health perspective, that is, targeting equity, social determinants of health, and health-in-all policies. Our study aimed to create a public health guidebook of strategies and indicators for multisectoral action on financial well-being and financial strain by decision makers in high-income contexts.

Methods

We used a multimethod approach to create the guidebook. We conducted a targeted review of existing theoretical and conceptual work on financial well-being and strain. By using rapid review methodology informed by principles of realist review, we collected data from academic and practice-based sources evaluating financial well-being or financial strain initiatives. We performed a critical review of these sources. We engaged our research–practice team and government and nongovernment partners and participants in Canada and Australia for guidance to strengthen the tool for policy and practice.

Results

The guidebook presents 62 targets, 140 evidence-informed strategies, and a sample of process and outcome indicators.

Conclusion

The guidebook supports action on the root causes of poor financial well-being and financial strain. It addresses a gap in the academic literature around relevant public health strategies to promote financial well-being and reduce financial strain. Community organizations, nonprofit organizations, and governments in high-income countries can use the guidebook to direct initiative design, implementation, and assessment.

Introduction

Austerity policies imposed over recent decades have worsened poverty and living conditions among various populations. With the economic market collapse, loss of livelihoods, and increased caring duties resulting from the COVID-19 pandemic, many people now face unprecedented levels of financial strain and poor financial well-being (1). The latest data from a Canadian survey showed that 57% of households reported deterioration of their financial situation because of the COVID-19 recession and its resultant job loss, temporary layoffs, and reduction in regular paid hours (1). The survey also showed that 48% of households with savings had sufficient resources to cover expenses for 3 months (vs 64% prepandemic), 28% of Canadians said they were short on money at the end of month (vs 19% prepandemic), and 3 in 4 Canadians reported increased stress from financial strain since the beginning of pandemic (1).

Financial strain is different from poverty. Poverty is an objective measure that captures a lack of basic needs (2). Financial strain (also referred as financial hardship, economic stress) (3) occurs when the financial discretionary and nondiscretionary expenditures of a person or household start to exceed their income to a degree that psychologically threatens their intimate relationships and self-esteem (3,4). Financial strain describes people’s current subjective experiences (3) and is an aspect of financial well-being (5). In turn, financial well-being includes objective and subjective measures of current and expected future financial circumstances (eg, economic security based on savings) (4,6). Neither concept is limited to the ability to afford basic needs; they include discretionary spending as part of the emphasis on freedom of choice (4,7–9). Recent resources exemplify how these multidimensional constructs have been measured (5,7).

Financial strain threatens people’s quality of life and health. Adults under financial strain are at higher risk of work absenteeism (10), depression, anxiety, and poor physical health (11–16). Their children are prone to loneliness, depression, other mental health issues, and disability into adulthood (12,16). Financial strain leads to poor health, and poor health leads to financial strain. Financial strain disproportionately affects equity-seeking groups including women, Indigenous peoples, seniors, and immigrants (3,17–19). People who have greater privileges (eg, property ownership, stable income) can also experience financial strain (20) related to life-course events (eg, having children, retirement) (7) or to unexpected events (eg, illness) (13).

To support populations in greater need, governments and organizations have implemented financial strain–related initiatives (21,22), for example, through income support. However, such programs and services offer only temporary relief, as observed during the global financial crisis caused by the pandemic. Greater synergy between government and nongovernment organizations is needed to address the root causes of financial strain and promote financial well-being following the pandemic. A gap exists between the use of current evidence and coordinated, equitable, system-level implementation (23). This article responds to this gap by presenting a public health guidebook of strategies and indicators (hereinafter Guidebook) for action on financial well-being and financial strain for use by policy makers and public health practitioners in high-income contexts (24).

Our Guidebook expands the operationalization of an action-oriented public health framework (hereinafter framework) we previously developed (25), which indicates 17 entry points for action grouped into 5 domains (Figure 1). Except for government at all levels, the other 4 domains are applicable to both governments and nongovernment organizations. The main goals of the Guidebook are to 1) strengthen the evidence base to support the design and implementation of more effective, equity-informed initiatives on any topic related to financial strain and financial well-being (eg, financial empowerment, employment supports) for various audiences (eg, 2SLGBTQIA+ [two-spirit, lesbian, gay, bisexual, transgender, queer or questioning, intersex, asexual, and additional sexual orientations and gender identities] communities, Indigenous peoples); 2) increase the evaluative capacity of governments and organizations in monitoring outcomes of their initiatives; 3) encourage reflection on whole-of-society contributions from other actors who share the same goals to improve understanding of the interconnectedness of actions; 4) support creating or strengthening partnerships between public, private, and nonprofit sectors; and 5) promote meaningful collaboration with community partners for enhanced relevance and cultural sensitiveness of initiatives.

![]()

Figure 1.

Action-oriented public health framework on financial well-being and financial strain. Reprinted with permission from: Action-oriented Public Health Framework on Financial Wellbeing and Financial Strain: Executive Summary (25). [A text version of the figure is available.]

Methods

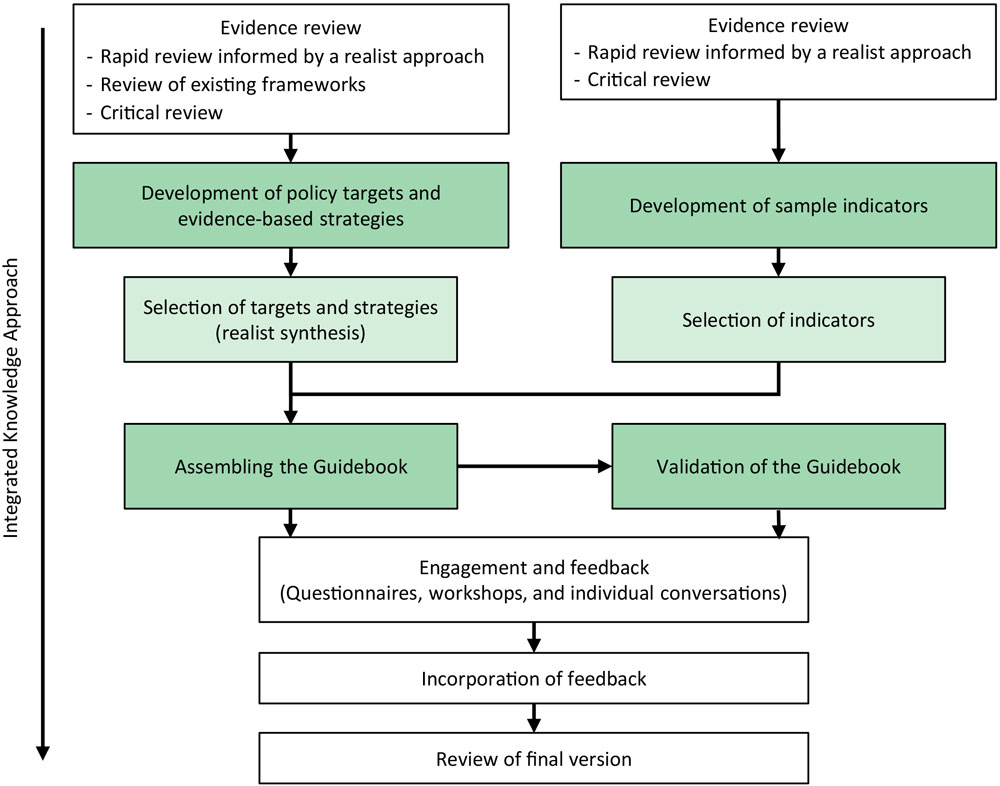

Our multimethod research–practice project, conducted in Canada and Australia, adopted an integrated knowledge translation process to enhance practical relevance and applicability of the Guidebook (Figure 2). We used a variety of methods to design the Guidebook (24).

![]()

Figure 2.

Integrated knowledge approach showing the 4 stages in the development of a policy-ready public health guidebook of strategies and indicators to promote financial well-being and address financial strain in response to the COVID-19 pandemic. [A text version of this figure is available.]

Integrated knowledge translation

An integrated knowledge translation approach informed the refinement and validation stages of the Guidebook. To ensure comprehensiveness, contextual appropriateness, cultural sensitivity, and practical relevance and to enhance usability of the resource in various practice settings, we engaged with practitioners, decision makers, policy makers, and researchers to incorporate academic and practice expertise and experiential knowledge. We first conducted a scan of Canadian and Australian national nonprofit organizations and government agencies directly or indirectly involved in the promotion of financial well-being or reduction of financial strain. To achieve professional and geographic diversity, we categorized the organizations according to location and sector. After reviewing the list for representation of diverse organizations, we performed a stakeholder analysis to purposively identify representatives of the selected government agencies and civil society in Canada and Australia as described above. The representatives were any staff member who was involved in a professional capacity with actions related to financial strain and financial well-being. By using available contact information from the organizations’ websites, we contacted each representative by email with an invitation letter. We asked representatives to forward the message to another member of their organization if they were unavailable to participate themselves. Participants were not asked to share any lived experiences with financial strain or with seeking help through support systems, although participants’ own lived experiences may have shaped their participation.

In Canada, 16 members affiliated with government (eg, financial sector, public health agencies), research centers, universities, and nonprofit organizations (eg, groups supporting Black female entrepreneurs, Indigenous communities, and women, girls and gender-diverse groups in the justice system) accepted our invitation and became our practice advisory committee (PAC). In Australia, only 6 representatives of organizations participated in the project despite extensive recruitment efforts; therefore, a PAC was not formed in Australia. Participants in both countries held positions as scientific directors, chief executive officers, project leads, research and policy analysts, and program coordinators. To support meaningful engagement of the participants and accommodate their needs, we employed different methods to collect their feedback: workshops, individual meetings, and online questionnaires.

Both the University of Alberta Research Ethics Board (Pro00102631) and the University of New South Wales Human Research Ethics Committee (HC200896) provided ethics approval to record written and verbal information and to use the data gathered through our workshops, surveys, and one-on-one conversations. All participants gave implied informed consent by proceeding with our data collection activities.

Targets and strategies

Through integrated knowledge translation activities, participants reached consensus about the need to indicate where to act and what to do for each of the 17 entry points for action in the framework. Participant feedback led to the development of targets and evidence-informed strategies to compose the Guidebook. We identified targets and strategies through the review of findings from a rapid review informed by a realist approach (26–29) and assessment of existing frameworks related to financial well-being and financial strain (Figure 2). These 2 methods were previously used in the methodology to develop the framework’s entry points for action (25).

Rapid review identified peer-reviewed academic and practice-based literature reporting community-led and government initiatives in high-income countries (30) that directly or indirectly aimed to promote financial well-being. We used Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) guidelines (31). We searched peer-reviewed resources published from 2015 through 2022 in MEDLINE, PsycINFO, and Web of Science (Social Science Citation Index) by using terms related to financial strain and financial well-being and initiative. We used ProQuest (ProQuest LLC) and Informit (Pearson Education, Informit) to identify practice-based resources and filtered the results by source type (eg, reports). Additionally, we performed a targeted search in Google Advanced (Google LLC) by using a modified version of the search terms and limitations from the search of peer-reviewed literature. With a predefined set of inclusion and exclusion criteria, 2 independent reviewers (A.P.B. and N.M.G.) each screened 50% of 3,516 peer-reviewed resources retrieved. A single reviewer (K.J.) assessed the 6,035 practice-based resources; a second reviewer (A.Y.) screened a 10% sample to minimize bias. The Mixed Methods Appraisal Tool (MMAT) (32) was applied for quality assessment of peer-reviewed literature on empirical research. We extracted data using EPPI-Reviewer software (EPPI Centre). We used equity principles to organize initiatives by level of intervention, reach, and impact (eg, universal, targeted) (33). To analyze the 39 peer-reviewed articles and 36 practice-based resources included in the review, we employed a realist approach (26–29) to identify underlying, contextual factors of intended and unintended outcomes and equity considerations. We applied a context-mechanism-outcome configuration to reveal what works for whom and in what circumstances. Through a collaborative data analysis process, we discussed the findings and used Miro (a visual collaboration platform; https://miro.com/) to map context-mechanism-outcome relationships. More information on the rapid review is published elsewhere (30).

We also identified 14 frameworks (4–8,34–42) on financial strain and financial well-being through a purposive literature search. By using social determinants of health (43,44), health equity (45–47), and health-in-all policy lenses (48,49), we developed a form to identify main characteristics, theoretical perspectives, and structural determinants and to assess strengths and limitations of these frameworks, which came from economic anthropology, happiness research, financial services, consumer research, and business, commerce, and marketing. Of note, only 1 framework came from public health (41) — a notable gap in the literature. In defining financial health as a function of saving, spending, borrowing, and planning activities, the framework was limited in its ability to articulate it as a social determinant of energy, housing, and food security.

We performed a critical review of academic and practice-based literature to identify further targets and strategies aligned with the 17 entry points of action in the Framework. We applied realist synthesis lenses (50) to select the most contextually relevant and appropriate targets and strategies to be included in the Guidebook. Feedback from the authors and participants through our workshops supported the development of targets and strategies.

Process and outcome indicators

We developed sample indicators to illustrate specific ways that organizations and governments could assess the progress and outcome effects of their initiatives (Figure 2). In the data extraction phase of the rapid review, we systematically identified indicators from the included resources. We documented indicators that were specific to different equity-seeking groups (eg, Black, Indigenous, youth, women, and immigrants). By using a data extraction template, we collected quantitative or qualitative, process, or outcome indicators from the main text, footnotes, figures, tables, and references of the academic and practice-based literature reviewed. We then created a summary table with all potentially relevant indicators. Indicators were then matched with the evidence-informed strategies.

To ensure a more diverse set of indicators to meet the needs of a wide range of initiatives and to address a lack of indicators for some strategies, we also reviewed resources included in the literature review and searched additional materials. We then further refined indicators to ensure equity focus and encourage disaggregated analysis by different social locations (eg, through social stratification).

Assembling, refining, and validating the Guidebook

The Guidebook comprises selected targets, evidence-informed strategies, and sample indicators related to the framework’s corresponding entry points for action. To inform refinement and validation of the Guidebook, we invited the research team, the Canadian PAC, and Australian representatives of community organizations to provide critical feedback on how to make it more feasible and relevant to community members, practitioners, policy makers, and researchers in Canada, Australia, and other high-income countries (Figure 2). They were asked to complete an online questionnaire and participate in a workshop or individual conversations, depending on their needs. This flexibility was necessary because our research began in the first year of the pandemic. The engagement activities occurred from September 2020 through May 2021.

We designed our questionnaire in the REDCap (Research electronic data capture) system (51). It was divided into the 5 domains and the 17 entry points for action of the framework, under which the corresponding targets and strategies were listed. In the evaluation of each target and strategy, we asked the following questions: “How can we strengthen the Guidebook? Please let us know how we can clarify the information and make the Guidebook more practice-oriented and user-friendly.” We set response categories to allow a single answer: clear or unclear. When unclear was marked, a pop-up question appeared to collect specific feedback and suggestions for improvement. At the end of each domain, we asked for any additional feedback, concerns, or suggestions for that specific domain. Our last multipart reflection question was “Based on your work experience and expertise, what is the relevance of these strategies to your practice? How might you use the strategies?” Research team members as well as the Canadian PAC received a REDCap link by email 1 week before the workshop; they had 1 week to complete the survey. The overall response rate for the survey was 45.4%.

We then held one Zoom (Zoom Video Communications, Inc) workshop each with the Canadian PAC and the research team to gather their collective feedback and support consensus building in a group setting, building on participants’ reflections from the survey. For the PAC workshop, we had 3 breakout rooms, given the high number of participants. Research staff in each breakout room provided some guidance to the discussion (eg, asking about what changes would make the Guidebook more practice-oriented and user-friendly) and took notes to report back at the large discussion session. Notes were shared with the entire group via Miro. For the research team workshop, we had a large group discussion, and L.M.N. took notes in Miro.

To respect the limited time available of the 6 Australian participants, we used a modified version of the survey questionnaire to collect their individual feedback in a one-on-one conversation. The anonymous, collective feedback was then used to revise the contents and formatting of the Guidebook. Feedback from the Canadian PAC and Australian participants improved clarity and enhanced relevance and usability of the Guidebook for diverse users.

Results

The Guidebook represents the culmination of the various stages of our multimethod research project. The final product (24) is a concise, yet substantial and comprehensive set of evidence-informed strategies and indicators to inform development, implementation, and evaluation of financial well-being initiatives (Figure 3). In total, the Guidebook presents 62 policy targets and 140 evidence-informed strategies, which correspond to the 17 entry points for action described in the framework. The list of indicators is not exhaustive; instead, the indicators are examples that can be used to support further brainstorming in the development or selection of other indicators specific to setting or population. English and French electronic versions of the Guidebook are available online on the Centre for Healthy Communities website (uab.ca/chc) and Centre for Health Equity Training Research and Evaluation website (https://chetre.org/).

![]()

Figure 3.

Sample pages from the Guidebook of Strategies and Indicators for Action on Financial Wellbeing & Financial Strain (24), a policy-ready public health guidebook of strategies and indicators to promote financial well-being and address financial strain in response to COVID-19. Reprinted with permission. [A text version of this figure is available.]

Using the Guidebook

To provide guidance on how to use the Guidebook, we developed a flowchart that is divided into stages of initiatives and steps. Stages of initiatives are design, implementation, and assessment (Figure 4). Use of the Guidebook starts with identification of the stage of the initiative. Next, the user follows the colored lines throughout the flowchart to identify the steps to be taken. The first 3 steps are about identifying domains, entry points for action, and targets. Steps 4 and 5 present prompts to support identification of strategies and indicators, respectively. Governments and organizations are invited to reflect on what additional entry points, targets, and strategies may further meet their needs and to combine those components. Indicators in the Guidebook are only examples; governments and organizations are encouraged to select or develop new ones that may better respond to their needs. Social stratification in the measurement of process and outcomes is highly recommended and some indicators are disaggregated by income, sex and gender, and other factors for illustrative purposes.

![]()

Figure 4.

Flowchart providing guidance for using the Guidebook of Strategies and Indicators for Action on Financial Wellbeing & Financial Strain (24). Reprinted with permission. [A text version of this figure is available.]

Audience

Our Guidebook was designed for researchers, practitioners, decision makers, and policy makers in Canada, Australia, and other high-income countries. The Guidebook’s strategies and indicators can be applied and adapted to the context and dynamics of each high-income country. Researchers can use the set of strategies when designing initiatives and apply the indicators in the Guidebook to evaluate their own initiatives or those led by other organizations and governments. For end users, the Guidebook facilitates the identification of high-impact strategies to reduce financial strain and improve financial well-being, thereby promoting health and equity. The Guidebook also presents indicators to support implementation evaluation and impact assessment. The Guidebook is applicable to the different contexts and mandates of private, public, and nonprofit organizations and to municipal, provincial, territorial, state, and federal governments. It can inform downstream, midstream, and upstream policies, programs, and services that directly or indirectly contribute to better outcomes in financial well-being, such as strategies to address systemic racism in the labor market, the housing affordability crisis, or issues related to expensive and low-quality, long-term care services. It can also inform actions targeting the unique needs of equity-seeking groups, such as women facing family violence or the elderly without retirement savings.

Discussion

We have introduced a comprehensive, action-oriented, public health Guidebook of strategies and indicators for organizations and governments in high-income countries working directly or indirectly on reducing financial strain and promoting financial well-being. The Guidebook provides a comprehensive set of evidence-informed strategies and process and outcome indicators to inform design, implementation, and assessment of financial well-being and initiatives related to financial strain. The Guidebook is the first of its kind. It integrates the literature on social determinants of health (43,44), health equity (45–47), and health-in-all policies (48,49) in the context of financial strain and financial well-being. In so doing, it de-emphasizes individual-level interventions that usually target financial behaviors; instead, it presents actions that governments and organizations can take to address the structural factors of financial strain and financial well-being. The Guidebook is an action-oriented resource that is meant to inform policies, programs, and services. It provides evidence-informed strategies for system-based solutions.

The Guidebook was developed under a rapid-response funding opportunity in response to the COVID-19 pandemic, which exacerbated financial strain. However, its utility is not limited to the pandemic period. It was designed for flexible use across various contexts to mitigate and prevent ongoing negative health consequences of enduring financial strain, or it can be applied in future global shocks such as another pandemic, environmental disaster, or economic recession.

The strategies and indicators commonly used in the literature to address and measure financial strain and poor financial well-being are narrow and overwhelmingly represent the concepts of behavioral economics (52). Such concepts, which are increasingly popular in social policy, economics, and psychology, have often been framed around the idea of individual financial decision making, emphasizing the individual’s behavior and responsibility for making rational decisions regarding the acquisition and consumption of resources. Very little attention has been paid to social determinants and other structural or system drivers of financial strain and well-being that are outside the individual’s ability to influence or control. Similarly, social and health inequities are not often examined in the context of the system drivers of financial strain and financial well-being. Also, little information is available on strategies for action and indicators of success to address and assess the long-term health effects of poor financial well-being and financial strain. The Guidebook addressed this gap in knowledge and practice by supporting public health practitioners, decision makers, policy makers, and researchers in high-income countries with initiative design, implementation, and assessment. The Guidebook presents a list of evidence-based high-impact actions that are more likely to have long-term, positive effects on people’s financial circumstances, particularly for equity-seeking groups.

Limitations

Our project had limitations. The Guidebook was developed under a rapid project process and originated within a framework that covered a wide range of areas. As such, we conducted a high-level review of the large amount of available evidence. We also recognize that the literature review we conducted to support the development of the strategies and indicators was not exhaustive and may not have captured all relevant literature in each topic area. To address both methodologic limitations, we combined multiple methods to collect and analyze academic and practice-based evidence and engaged with an international, interdisciplinary group of academics, practitioners, and representatives of governments that provided critical feedback on the items included in the Guidebook. PAC members in Canada and stakeholders in Australia were purposively selected to represent a broad, diverse body of policy and technical expertise. Their extensive knowledge helped select a variety of appropriate and relevant policy targets and strategies alongside technically sound, feasible, and meaningful indicators that are responsive to user needs.

Additionally, rapid review methodology with realist components is being employed increasingly in evaluation and implementation research (53,54). However, we found few examples of its use for the development of a guidebook (53,55). As such, this project represents a novel approach to evidence synthesis and translating knowledge into action that may guide future research–practice collaborations.

Conclusion

Greater synergy between public health and government, community, and financial sectors is needed to assess the impact of financial strain and to design and implement financial well-being initiatives. Our multimethod collaborative research project represents the collective efforts of members of academia, government, and nonprofit organizations to develop, within a short timeframe and at the height of the pandemic, a relevant and useful tool to guide action on financial strain and financial well-being over the short and long term. The Guidebook is a key step in addressing the significant existing gap in public health evidence and action-oriented resources to promote financial well-being and reduce financial strain for all populations, but particularly for equity-seeking groups. The actionable areas presented in the Guidebook can inform initiatives that have the potential to achieve sustained, positive progress in securing financial well-being in the long term and to promote equitable conditions for all people to enjoy financial security. The Guidebook delineates the complex strategies of equitable, systems-oriented action needed to address financial strain and financial well-being through coordinated, transdisciplinary, multidisciplinary initiatives.

In our efforts to address uptake barriers (eg, language, knowledge, skills) and improve reach to different target audiences (56), we will continue to partner with government sectors and professional and community organizations and to attend scientific and practice-based events to share the Guidebook widely. The Guidebook is a living document. Feedback provided by end users will be reviewed and, where appropriate, incorporated in future versions of the Guidebook. To optimize dissemination of the Guidebook, our next step will be to create a user-friendly, interactive, web-based version to support end-users’ nonlinear, more flexible interaction with the Guidebook.

Acknowledgments

We are grateful to all Practice Advisory Committee members in Canada and participants in Australia for their careful review and expert input that were critical to the refinement of the Guidebook. We acknowledge Meghan Sebastianski, PhD, and Diana Keto-Lambert, MLIS, from the Alberta Strategy for Patient-Oriented Research Support Unit Knowledge Translation Platform for their support with the academic literature search and guidance on the practice literature search. The Canadian Institute of Health Research (CIHR; 2020 COVID-19 Rapid Research Funding Opportunity; grant #172694) provided financial support to this project. Authors have no conflicts of interest to declare. No copyrighted materials or tools were used in this article.

Authors contributed to this article as follows:

Candace I.J. Nykiforuk made substantial contributions to the design of the article and drafted and gave final approval of the version submitted for publication. She agreed to be accountable for all aspects of the work in ensuring that questions related to the accuracy or integrity of any part were appropriately investigated and resolved.

Ana Paula Belon acquired, analyzed, and interpretated data for the article and participated in drafting and approving the final version of the article submitted for publication. She agreed to be accountable for all aspects of the work, in ensuring that questions related to the accuracy or integrity of any part of the work were appropriately investigated and resolved.

Evelyne de Leeuw, Patrick Harris, Lisa Allen Scott, Elaine Hyshka, Stephanie Montesanti, Roman Pabayo, and Jane Springett made substantial contributions to the design of the article and revised it critically for important intellectual content. Each gave final approval of the version submitted for publication and agreed to be accountable for all aspects of the article ensuring that questions related to the accuracy or integrity of any part were appropriately investigated and resolved.

Kayla Atkey, Nicole M Glenn, Karla Jaques, Krystyna Kongats, Laura M Nieuwendyk, and Aryati Yashadhana acquired, analyzed, and interpreted data for the article; revised the article critically for important intellectual content; and gave final approval of the version submitted for publication. Each agreed to be accountable for all aspects of the article, ensuring that questions related to the accuracy or integrity of any parts were appropriately investigated and resolved.

Author Information

Corresponding Author: Candace IJ Nykiforuk, PhD, Professor and Scientific Director, Centre for Healthy Communities, School of Public Health, University of Alberta, ECHA 3-300, 11405-87 Ave, Edmonton, AB, Canada T6G 1C9. (candace.nykiforuk@ualberta.ca).

Author Affiliations: 1Centre for Healthy Communities, School of Public Health, University of Alberta, Edmonton, Alberta, Canada. 2Centre for Health Equity Training, Research and Evaluation, University of New South Wales, Liverpool, New South Wales, Australia. 3Ingham Institute for Applied Medical Research and South West Sydney Local Health District, Liverpool Hospital, Liverpool, New South Wales, Australia. 4Provincial Population and Public Health, Alberta Health Services, Calgary, Alberta, Canada.

References

- Summary of findings COVID-19 surveys: financial impact of the pandemic on Canadians. Ottawa (CA): Government of Canada, Financial Consumer Agency of Canada; 2021. Accessed August 23, 2022. https://www.canada.ca/en/financial-consumer-agency/corporate/covid-19/summary-covid-19-surveys.html

- World Vision. What is poverty? It is not as simple as you think. 2022. Accessed June 1, 2022. https://www.worldvision.ca/stories/child-sponsorship/what-is-poverty

- French D, Vigne S. The causes and consequences of household financial strain: a systematic review. Int Rev Financ Anal 2019;62:150–6. CrossRef

- Financial Consumer Agency of Canada, Government of Canada. Financial well-being in Canada: survey results. Ottawa: Financial Consumer Agency of Canada; 2019. Accessed May 3, 2022. https://www.canada.ca/content/dam/fcac-acfc/documents/programs/research-surveys-studies-reports/financial-well-being-survey-results.pdf

- Netemeyer RG, Warmath D, Fernandes D, Lynch JG Jr. How am I doing? Perceived financial well-being, its potential antecedents, and its relation to overall well-being. J Consum Res 2018;45(1):68–89. CrossRef

- Brüggen EC, Hogreve J, Holmlund M, Kabadayi S, Löfgren M. Financial well-being: a conceptualization and research agenda. J Bus Res 2017;79:228–37. CrossRef

- Salignac F, Hamilton M, Noone J, Marjolin A, Muir K. Conceptualizing financial wellbeing: an ecological life-course approach. J Happiness Stud 2020;21(5):1581–602. CrossRef

- Storchi S, Johnson S. Financial capability for wellbeing: an alternative perspective from the capability approach. Bath: Centre for Development Studies (CDS); University of Bath; 2016. Accessed April 19, 2022. https://researchportal.bath.ac.uk/en/publications/financial-capability-for-wellbeing-an-alternative-perspective-fro

- Kahn JR, Pearlin LI. Financial strain over the life course and health among older adults. J Health Soc Behav 2006;47(1):17–31. CrossRef PubMed

- Kim J, Garman ET. Financial stress and absenteeism: an empirically derived research model. Financ Couns Plan 2003;14(1):1–13.

- Frank C, Davis CG, Elgar FJ. Financial strain, social capital, and perceived health during economic recession: a longitudinal survey in rural Canada. Anxiety Stress Coping 2014;27(4):422–38. CrossRef PubMed

- Szanton SL, Thorpe RJ, Whitfield K. Life-course financial strain and health in African-Americans. Soc Sci Med 2010;71(2):259–65. CrossRef PubMed

- Macy JT, Chassin L, Presson CC. Predictors of health behaviors after the economic downturn: a longitudinal study. Soc Sci Med 2013;89:8–15. CrossRef PubMed

- Savoy EJ, Reitzel LR, Nguyen N, Advani PS, Fisher FD, Wetter DW, et al. Financial strain and self-rated health among Black adults. Am J Health Behav 2014;38(3):340–50. CrossRef PubMed

- Szanton SL, Allen JK, Thorpe RJ Jr, Seeman T, Bandeen-Roche K, Fried LP. Effect of financial strain on mortality in community-dwelling older women. J Gerontol B Psychol Sci Soc Sci 2008;63(6):S369–74. CrossRef PubMed

- Davis CG, Mantler J. The consequences of financial stress for individuals, families, and society. Ottawa: Doyle Salewski Inc, Carleton University; 2004.

- Van Houtven CH, Friedemann-Sánchez G, Clothier B, Levison D, Taylor BC, Jensen AC, et al. Is policy well-targeted to remedy financial strain among caregivers of severely injured U.S. service members? Inquiry 2012-2013;49(4):339–51. CrossRef PubMed

- Hanratty B, Holland P, Jacoby A, Whitehead M. Financial stress and strain associated with terminal cancer — a review of the evidence. Palliat Med 2007;21(7):595–607. CrossRef PubMed

- Canada Without Poverty. Poverty: just the facts 2021. Accessed January 11, 2022. http://www.cwp-csp.ca/poverty/just-the-facts/.

- Cannuscio CC, Alley DE, Pagán JA, Soldo B, Krasny S, Shardell M, et al. Housing strain, mortgage foreclosure, and health. Nurs Outlook 2012;60(3):134–42, 142.e1. CrossRef PubMed

- Whitehead M, Taylor-Robinson D, Barr B. Poverty, health, and COVID-19. BMJ 2021;372:n376. CrossRef PubMed

- International Labour Organization. COVID-19 and the world of work: impact and policy responses. 2020. Accessed December 7, 2022. COVID-19 and the world of work (COVID-19 and the world of work) (ilo.org)

- Wensing M, Sales A, Armstrong R, Wilson P. Implementation science in times of Covid-19. Implement Sci 2020;15(1):42. CrossRef PubMed

- Centre for Healthy Communities [CHC], Centre for Health Equity Training Research and Evaluation [CHETRE]. Guidebook of strategies and indicators for action on financial well-being & financial strain: executive summary. Edmonton (Canada): Centre for Healthy Communities; 2022. Accessed April 1, 2022. https://www.ualberta.ca/public-health/research/centres/centre-for-healthy-communities/what-we-do/guidebook_eng_2022.pdf

- Centre for Healthy Communities [CHC], Centre for Health Equity Training Research and Evaluation [CHETRE]. Action-oriented public health framework on financial wellbeing and financial strain: executive summary. Edmonton (Canada): Centre for Healthy Communities; 2022. Accessed April 1, 2022. https://www.ualberta.ca/public-health/research/centres/centre-for-healthy-communities/what-we-do/framework_eng_2022.pdf

- Bhaskar R. A realist theory of science. New York (NY): Routledge; 2008.

- Sayer A. Abstraction: a realist interpretation. In: Archer M, Bhaskar R, Collier A, Lawson T, Norrie A, editors. Critical realism: essential readings. London (UK): Routledge; 1998. pp 120–43.

- Dalkin SM, Greenhalgh J, Jones D, Cunningham B, Lhussier M. What’s in a mechanism? Development of a key concept in realist evaluation. Implement Sci 2015;10(1):49. CrossRef PubMed

- Saul JE, Willis CD, Bitz J, Best A. A time-responsive tool for informing policy making: rapid realist review. Implement Sci 2013;8(1):103. CrossRef PubMed

- Glenn NM, Yashadhana A, Jaques K, Belon A, de Leeuw E, Nykiforuk CIJ, et al. The generative mechanisms of financial strain and financial well-being: a critical realist analysis of ideology and difference. Int J Health Policy Manag 2022. CrossRef

- Moher D, Liberati A, Tetzlaff J, Altman DG; PRISMA Group. Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. PLoS Med 2009;6(7):e1000097. CrossRef PubMed

- Hong QN, Pluye P, Fàbregues S, Bartlett G, Boardman F, Cargo M, et al. Mixed methods appraisal tool (MMAT), version 2018. Montréal, QC, Canada: McGill University; 2018. http://mixedmethodsappraisaltoolpublic.pbworks.com/w/file/fetch/127916259/MMAT_2018_criteria-manual_2018-08-01_ENG.pdf

- Public Health Agency of Canada. Toward health equity: a tool for developing equity-sensitive public health interventions. Ottawa (Canada): 2015. Accessed November 1, 2021. https://nccdh.ca/resources/entry/toward-health-equity-a-tool-for-developing-equity-sensitive-public-health-i

- Bowman D, van Kooy J. Inclusive work and economic security: a framework. Working paper. Brotherhood of St Laurence; 2016. Accessed February 1, 2022. https://library.bsl.org.au/jspui/bitstream/1/9350/3/Bowman_vanKooy_Inclusive_work_econ_security_framework_2016.pdf

- Pathways to financial well-being: the role of financial capability. Research Brief. US Bureau of Consumer Financial Protection; 2018. Accessed March 18, 2022. https://files.consumerfinance.gov/f/documents/bcfp_financial-well-being_pathways-role-financial-capability_research-brief.pdf

- Daniels C, Buli E, Davis A, O’Mally J, Pasco B. Yarnin’ money: 2019 report. North Cairns (QLD): Indigenous Consumer Assistance Network Ltd; 2019. Accessed November 10, 2021. https://ican.org.au/wp-content/uploads/2019/05/YMReport2019.pdf

- Fu J. Ability or opportunity to act: what shapes financial well-being? World Dev 2020;128:104843. CrossRef

- Hardy B, Hill HD, Romich J. Strengthening social programs to promote economic stability during childhood. Soc Policy Rep 2019;32(2):1–36. CrossRef PubMed

- Ladha T, Asrow K, Parker S, Rhyne E, Kelly S. Beyond financial inclusion: financial health as a global framework. Center for Financial Services Innovation (CFSI) and Center for Financial Inclusion at Accion; 2017. Accessed November 15, 2021. https://content.centerforfinancialinclusion.org/wp-content/uploads/sites/2/2017/03/FinHealthGlobal-FINAL.2017.04.11.pdf

- Muir K, Hamilton M, Noone JH, Marjolin A, Salignac F, Saunders P. Exploring financial well-being in the Australian context. Sydney (AU): Centre for Social Impact, Social Policy Research Centre, University of New South Wales, Financial Literacy Australia; 2017. Accessed October 1, 2021. https://assets.csi.edu.au/assets/research/Exploring-Financial-Wellbeing-in-the-Australian-Context-Report.pdf

- Weida EB, Phojanakong P, Patel F, Chilton M. Financial health as a measurable social determinant of health. PLoS One 2020;15(5):e0233359. CrossRef PubMed

- White ND, Packard K, Kalkowski J. Financial education and coaching: a lifestyle medicine approach to addressing financial stress. Am J Lifestyle Med 2019;13(6):540–3. CrossRef PubMed

- Solar O, Irwin A. A conceptual framework for action on the social determinants of health. Geneva: World Health Organization; 2010. Accessed June 8, 2021. https://apps.who.int/iris/handle/10665/44489

- Working Group for Monitoring Action on the Social Determinants of Health. Towards a global monitoring system for implementing the Rio Political Declaration on Social Determinants of Health: developing a core set of indicators for government action on the social determinants of health to improve health equity. Int J Equity Health 2018;17(1):136. CrossRef PubMed

- Glover RE, van Schalkwyk MCI, Akl EA, Kristjannson E, Lotfi T, Petkovic J, et al. A framework for identifying and mitigating the equity harms of COVID-19 policy interventions. J Clin Epidemiol 2020;128:35–48. CrossRef PubMed

- Haworth-Brockman M, Betker C. Measuring what counts in the midst of the COVID-19 pandemic: equity indicators for public health. National Collaborating Centre for Infectious Diseases; 2020. Accessed January 11, 2022. https://nccid.ca/publications/measuring-what-counts-in-the-midst-of-the-covid-19-pandemic-equity-indicators-for-public-health/

- From risk to resilience: an equity approach to COVID-19. Ottawa: Public Health Agency of Canada; 2020. Accessed February 19, 2022. https://www.canada.ca/en/public-health/corporate/publications/chief-public-health-officer-reports-state-public-health-canada/from-risk-resilience-equity-approach-covid-19.html

- The South Australian approach to Health in All Policies: background and practical guide. Rundle Mall (AU): Department of Health; Government of South Australia; 2011. Accessed May 02, 2022. https://www.sahealth.sa.gov.au/wps/wcm/connect/cb6fa18043aece9fb510fded1a914d95/HiAPBackgroundPracticalGuide-v2.pdf?MOD=AJPERES&CACHEID=ROOTWORKSPACE-cb6fa18043aece9fb510fded1a914d95-nKQwWsc

- World Health Organization. Health in all policies: framework for country action. Geneva (CH): World Health Organization; 2014. Accessed July 7, 2021. https://www.paho.org/en/documents/health-all-policies-global-framework-country-action

- de Leeuw E, Green G, Dyakova M, Spanswick L, Palmer N. European Healthy Cities evaluation: conceptual framework and methodology. Health Promot Int 2015;30(Suppl 1):i8–17. CrossRef PubMed

- Harris PA, Taylor R, Thielke R, Payne J, Gonzalez N, Conde JG. Research electronic data capture (REDCap)—a metadata-driven methodology and workflow process for providing translational research informatics support. J Biomed Inform 2009;42(2):377–81. CrossRef PubMed

- Bowman D, Banks M, Fela G, Russell R, de Silva A. Understanding financial well-being in times of insecurity: working paper. Fitzroy (AU): Brotherhood of St Laurence; 2017. Accessed November 19, 2021. https://library.bsl.org.au/jspui/bitstream/1/9423/1/Bowman_etal_Understanding_financial_wellbeing_2017.pdf

- Gagliardi AR, Légaré F, Brouwers MC, Webster F, Wiljer D, Badley E, et al. Protocol: developing a conceptual framework of patient mediated knowledge translation, systematic review using a realist approach. Implement Sci 2011;6(1):25. CrossRef PubMed

- Lacouture A, Breton E, Guichard A, Ridde V. The concept of mechanism from a realist approach: a scoping review to facilitate its operationalization in public health program evaluation. Implement Sci 2015;10(1):153. CrossRef PubMed

- Statistics Canada. The social and economic impacts of COVID-19: a six-month update. Statistics Canada; 2020. Accessed October 21, 2021. https://www150.statcan.gc.ca/n1/pub/11-631-x/11-631-x2020004-eng.htm

- Matta G. Science communication as a preventative tool in the COVID-19 pandemic. Humanit Soc Sci Commun. 2020;7(1):159. CrossRef

The opinions expressed by authors contributing to this journal do not necessarily reflect the opinions of the U.S. Department of Health and Human Services, the Public Health Service, the Centers for Disease Control and Prevention, or the authors’ affiliated institutions.