High-deductible Health Plan Enrollment Among Adults Aged 18–64 With Employment-based Insurance Coverage

- Key findings

- Among adults aged 18–64 with employment-based coverage, the type of coverage has changed over the past decade.

- Among adults aged 18–64 with employment-based coverage, enrollment in plan type varied by age but not by sex.

- As family income level increased, enrollment in HDHPs with an HSA increased, while enrollment in HDHPs without an HSA decreased.

- As educational attainment increased, enrollment in HDHPs with an HSA increased, while enrollment in traditional plans and HDHPs without an HSA decreased.

- Summary

- Definitions

- Data source and methods

- About the authors

- References

- Suggested citation

PDF Version (442 KB)

Robin A. Cohen, Ph.D., and Emily P. Zammitti, M.P.H.

Key findings

Data from the National Health Interview Survey

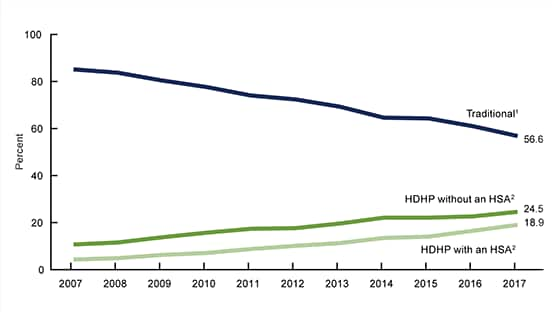

- From 2007 through 2017, enrollment in high-deductible health plans (HDHPs) with a health savings account (HSA) (4.2% to 18.9%) and without an HSA (10.6% to 24.5%) increased among adults aged 18–64 with employment-based coverage, while enrollment in traditional plans decreased.

- In 2017, among adults aged 18–64 with employment-based coverage, there were no differences in the types of health insurance plan by sex.

- Enrollment in an HDHP with an HSA was higher among adults aged 30–44 (21.0%) than among those aged 18–29 (16.8%) and 45–64 (18.4%).

- Enrollment in HDHPs with an HSA increased with increasing family income level and educational attainment, whereas the percentage enrolled in traditional plans and HDHPs without an HSA decreased.

High-deductible health plans (HDHPs) are health insurance policies with higher deductibles than traditional insurance plans. Individuals with HDHPs pay lower monthly insurance premiums but pay more out of pocket for medical expenses until their deductible is met. An HDHP may be used with or without a health savings account (HSA). An HSA allows pretax income to be saved to help pay for the higher costs associated with an HDHP (1). This report examines enrollment among adults aged 18–64 with employment-based private health insurance coverage by plan type and demographic characteristics. Approximately 60% of adults aged 18–64 have employment-based coverage (2). All estimates in this report are based on data from the National Health Interview Survey (NHIS).

Keywords: health insurance, private plan, National Health Interview Survey

Among adults aged 18–64 with employment-based coverage, the type of coverage has changed over the past decade.

- Among adults aged 18–64 with employment-based coverage, the percentage enrolled in a traditional plan decreased from 85.1% in 2007 to 56.6% in 2017 (Figure 1).

- The percentage enrolled in an HDHP without an HSA increased from 10.6% in 2007 to 24.5% in 2017 among adults aged 18–64 with employment-based coverage.

- Among adults aged 18–64 with employment-based coverage, the percentage enrolled in an HDHP with an HSA increased from 4.2% in 2007 to 18.9% in 2017.

Figure 1. Percentage of adults aged 18–64 with employment-based coverage, by type of private coverage and year: United States, 2007–2017

1Significant linear decrease from 2007 through 2017 (p < 0.05).

2Significant linear increase from 2007 through 2017 (p < 0.05).

NOTES: HDHP is a high-deductible health plan. HSA is a health savings account. Estimates are based on household interviews of a sample of the civilian noninstitutionalized population. Due to rounding, percentages may not add up to 100 within each year. Access data table for Figure 1.

SOURCE: NCHS, National Health Interview Survey, 2017

Among adults aged 18–64 with employment-based coverage, enrollment in plan type varied by age but not by sex.

- Among adults aged 18–64 with employment-based coverage, there was no difference in the type of health insurance plan by sex (Figure 2).

- Among adults aged 18–64 with employment-based coverage, those aged 18–29 (16.8%) and 45–64 (18.4%) were less likely to be enrolled in an HDHP with an HSA than those aged 30–44 (21.0%). There were no differences by age in the percentages enrolled in an HDHP without an HSA or in a traditional plan.

Figure 2. Percent distribution of adults aged 18–64 with employment-based coverage, by sex, age group, and type of private coverage: United States, 2017

1Significantly different from those aged 30–44 (p < 0.05).

NOTES: HDHP is a high-deductible health plan. HSA is a health savings account. Estimates are based on household interviews of a sample of the civilian noninstitutionalized population. Due to rounding, percentages may not add up to 100 within each sex and age group category. Access data table for Figure 2.

SOURCE: NCHS, National Health Interview Survey, 2017.

As family income level increased, enrollment in HDHPs with an HSA increased, while enrollment in HDHPs without an HSA decreased.

- In 2017, among adults aged 18–64 with employment-based coverage, enrollment in traditional plans decreased with increasing family income, from 59.9% among those with incomes of 138% of the federal poverty level (FPL) or less to 55.5% among those with incomes greater than 400% FPL (Figure 3).

- Enrollment in HDHPs without an HSA decreased from 32.2% among those with incomes of 138% FPL or less to 22.6% among those with incomes greater than 400% FPL.

- Enrollment in HDHPs with an HSA increased from 7.9% among those with incomes of 138% FPL or less to 22.0% among those with incomes greater than 400% FPL.

Figure 3. Percent distribution of adults aged 18–64 with employment-based coverage, by family income and type of private coverage: United States, 2017

1Significant linear decrease with increasing family income level (p < 0.05).

2Significant linear increase with increasing family income level (p < 0.05).

NOTES: HDHP is a high-deductible health plan. HSA is a health savings account. FPL is federal poverty level, which is based on the ratio of the family’s income in the previous calendar year to the appropriate poverty threshold as defined by the U.S. Census Bureau. Estimates are based on household interviews of a sample of the civilian noninstitutionalized population. Due to rounding, percentages may not add up to 100 within each family income level. Access data table for Figure 3.

SOURCE: NCHS, National Health Interview Survey, 2017.

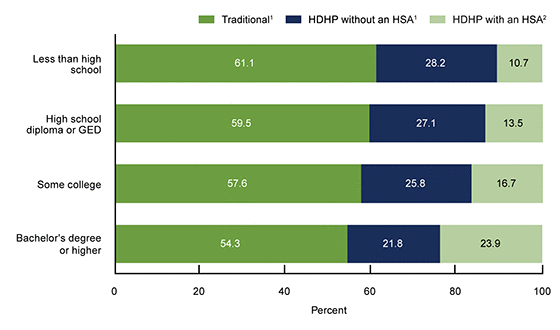

As educational attainment increased, enrollment in HDHPs with an HSA increased, while enrollment in traditional plans and HDHPs without an HSA decreased.

- In 2017, among adults aged 18–64 with employment-based coverage, enrollment in traditional plans decreased from 61.1% among those with less than a high school education to 54.3% among those with a bachelor’s degree or higher (Figure 4).

- Enrollment in HDHPs without an HSA decreased with increasing educational attainment, from 28.2% among those with less than a high school education to 21.8% among those with a bachelor’s degree or higher.

- Enrollment in HDHPs with an HSA increased with increasing educational attainment, from 10.7% among those with less than a high school education to 23.9% among those with a bachelor’s degree or higher.

Figure 4. Percent distribution of adults aged 18–64 with employment-based coverage, by educational attainment and type of private coverage: United States, 2017

1Significant linear decrease with increasing educational attainment (p < 0.05).

2Significant linear increase with increasing educational attainment (p < 0.05)

NOTES: HDHP is a high-deductible health plan. HSA is a health savings account. Estimates are based on household interviews of a sample of the civilian noninstitutionalized population. Due to rounding, percentages may not add up to 100 in each educational attainment category. Access data table for Figure 4.

SOURCE: NCHS, National Health Interview Survey, 2017.

Summary

Enrollment in HDHPs with and without HSAs among adults aged 18–64 with employment-based coverage increased from 2007 through 2017. Sociodemographic and socioeconomic factors were associated with enrollment in HDHPs with and without HSAs among adults aged 18–64 with employment-based coverage. In 2017, adults aged 30–44 were more likely to be enrolled in an HDHP with an HSA than those aged 18–29 and 45–64. However, no differences by age were observed for enrollment in HDHPs without an HSA or traditional plans. More highly educated and affluent adults were more likely to be enrolled in an HDHP with an HSA and less likely to be enrolled in a traditional plan or an HDHP without an HSA than their less educated and less affluent counterparts.

More than 60% of adults aged 18–64 in the United States obtain their private health insurance coverage through the workplace (2). The change in HDHP enrollment has been faster among those with employment-based coverage than among those with directly purchased coverage (3). NHIS will continue to monitor the different types of private health insurance, and NHIS data can be used to examine further differences according to plan type.

Definitions

Employment-based coverage: Private insurance originally obtained through a present or former employer, union, or professional association.

Family income level: Categories are based on the ratio of the family’s income in the previous calendar year to the appropriate poverty threshold (given the family’s size and number of children), as defined by the U.S. Census Bureau.

Health savings account (HSA): A tax-advantaged account or fund that can be used to pay medical expenses. HSAs may only be used by those with an HDHP. These plans are also referred to as consumer-directed health plans. The funds contributed to the account are not subject to federal income tax at the time of deposit. HSA funds roll over and accumulate from year to year if not spent. HSAs are owned by the individual. Funds may be used to pay qualified medical expenses at any time without federal tax liability. HSAs may also be referred to as health reimbursement accounts, personal care accounts, personal medical funds, or choice funds. The term “HSA” in this report includes accounts that use these alternative names. These accounts differ from flexible spending accounts (FSAs). FSAs are accounts offered by some employers to allow employees to set aside pretax dollars of their own money for their use throughout the year to reimburse themselves for their out-of-pocket expenses for health care. With this type of account, any money remaining in the account at the end of the year, following a short grace period, is lost to the employee. Some FSAs allow a small amount of the money to roll over into the next calendar year.

High-deductible health plan (HDHP): For persons with private health insurance, a question was asked regarding the annual deductible of each private health insurance plan. HDHP was defined in 2015 through 2017 as a private health plan with a deductible of at least $1,300 for self-only coverage and $2,600 for family coverage. The deductible is adjusted annually for inflation. For 2013 and 2014, the annual deductible was $1,250 for self-only coverage and $2,500 for family coverage. For 2010 through 2012, the annual deductible was $1,200 for self-only coverage and $2,400 for family coverage. For 2009, the annual deductible was $1,150 for self-only coverage and $2,300 for family coverage. For 2007 and 2008, the annual deductible was $1,100 for self-only coverage and $2,200 for family coverage.

Private health insurance: Includes persons who had any comprehensive private insurance plan (including health maintenance and preferred provider organizations). These plans include those obtained through an employer, purchased directly, purchased through local or community programs, or purchased through the Health Insurance Marketplace or a state-based exchange. Private coverage excludes plans that pay for only one type of service, such as accidents or dental care.

Traditional health plan: For persons with private health insurance, a question was asked regarding the annual deductible of each private health insurance plan. A traditional plan was defined as a private health plan with an annual deductible less than the HDHP threshold for the given year.

Data source and methods

NHIS is a nationally representative survey of the civilian noninstitutionalized U.S. population that is conducted continuously throughout the year by the National Center for Health Statistics (NCHS). NHIS is an in-person interview conducted in the respondent’s home. In some instances, follow-up to complete the interview is conducted via telephone.

NHIS is designed to yield a nationally representative sample, and these analyses used weights to produce national estimates that are representative of the civilian noninstitutionalized population of the United States. Point estimates and the corresponding variances were calculated using SUDAAN software (4) to account for the complex sample design of NHIS. All estimates in this report meet NCHS standards of reliability as specified in “National Center for Health Statistics Data Presentation Standards for Proportions” (5). Linear trends by year, family income level, and educational attainment were evaluated using logistic regression. Differences between percentages were evaluated using two-sided significance tests at the 0.05 level.

Data analysis for 2017 was based on information collected on 46,688 adults aged 18–64 in the NHIS Family Core component. Visit the NHIS website for more information about the design, content, and use of NHIS.

About the authors

Robin A. Cohen and Emily P. Zammitti are with the National Center for Health Statistics, Division of Health Interview Statistics.

References

- United States Government Accountability Office. Consumer-directed health plans: Early enrollee experiences with health savings accounts and eligible health plans. GAO–06–798. Washington, DC. 2006.

- National Center for Health Statistics. Health, United States, 2016: With Chartbook on Long-term Trends in Health. Hyattsville, MD. 2017.

- Cohen RA, Zammitti EP. High-deductible health plans and financial barriers to medical care: Early release of estimates from the National Health Interview Survey, 2016. National Center for Health Statistics. 2017.

- RTI International. SUDAAN (Release 11.0.01) [computer software]. 2013.

- Parker JD, Talih M, Malec DJ, Beresovsky V, Carroll M, Gonzalez Jr JF, et al. National Center for Health Statistics Data Presentation Standards for Proportions. National Center for Health Statistics. Vital Health Stat 2(175). 2017.

Suggested citation

Cohen RA, Zammitti EP. High-deductible health plan enrollment among adults aged 18–64 with employment-based insurance coverage. NCHS Data Brief, no 317. Hyattsville, MD: National Center for Health Statistics. 2018.

Copyright information

All material appearing in this report is in the public domain and may be reproduced or copied without permission; citation as to source, however, is appreciated.

National Center for Health Statistics

Charles J. Rothwell, M.S., M.B.A., Director

Jennifer H. Madans, Ph.D., Associate Director for Science

Division of Health Interview Statistics

Stephen J. Blumberg, Ph.D., Director

Robin A. Cohen, Ph.D., Acting Associate Director for Science