MarketScan

Commercial Insurance Claims at a Glance

| MarketScan® Commercial Claims & Encounters (CCAE) | |

|---|---|

| Description | Commercial medical insurance claims |

| Sample | Convenience sample of privately insured patients |

| VEHSS Topics Included |

|

| Approximate Size | 43.6 million persons |

The MarketScan Commercial Claims and Encounters Data (CCAE) is produced by IBM. The CCEA data contain a convenience sample of insurance claims information from persons with employer-sponsored insurance and their dependents, including 43.6 million person-years of data in 20161. Several types of insurance plans are included in the CCAE including fee-for-service, partial capitation, and full capitation. Benefit designs of persons insured include preferred and exclusive provider organizations, point-of-service plans, indemnity plans, health maintenance organizations (HMOs), and consumer-directed health plans (CDHPs). Encounter level data include diagnoses and procedures, insurer, and insurer and patient paid amounts from outpatient, inpatient, pharmacy, laboratory, and dental claims. Services can be linked by unique patient ID to patient characteristics as measured and included in a separate patient enrollment file. Because patient characteristics are dependent on information included in enrollment forms, some demographic variables (in particular race/ethnicity) are limited. MarketScan does not include vision insurance claims that are not covered by the patient’s primary insurer.

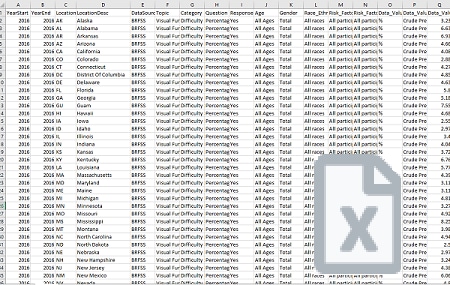

The VEHSS team calculated prevalence of diagnosed eye and vision disorders and prevalence of receipt of covered eye care services in MarketScan® claims based on the presence of ICD9 and ICD10 diagnosis codes and CPT procedure codes on any patient claim during the year of observation.

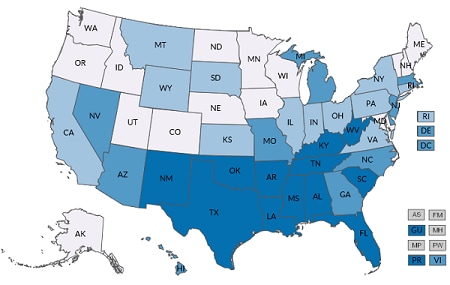

VEHSS reports summary prevalence and counts for the topics and categories listed, by the geographic levels and stratification factors listed below:

Available Geographic Levels

| National | State* |

|---|---|

*South Carolina suppressed in state-level results

| Included Stratification Factors (State and National Estimates) | |

|---|---|

| Age Group |

|

| Gender |

|

| Race/Ethnicity |

|

| Risk Factors |

|

*Ages 85+ suppressed due to small sample size

A detailed description of the analytical steps is described in the report “VEHSS Claims & Registry Data Analysis Plan [PDF – 579 KB].”

Full analysis documentation is included in the “VEHSS MarketScan® Data Report [PDF – 1.5 MB].”

Although the MarketScan CCAE is very large convenience sample, it is not nationally representative. Additionally, differences in patient characteristics, and representation of plan and benefit type between it and the universe of all privately insured individuals has not been assessed. With those limitations in mind, because of its large sample, information from the MarketScan® CCAE is likely related to what would be found in the full population of those privately insured. However, users of the data should be cautioned that the CCAE information is not representative, and results derived from it may differ substantially from what would be found using a representative sample of privately insured persons. Differences between the MarketScan® sample and the population of all privately insured individuals are likely most extreme at the state level, especially in some smaller states where limited insurers participate in the system.

Additional limitations of the of the VEHSS analysis of MarketScan® commercial insurance data include:

- Commercial insurance claims are intended for billing purposes only. Diagnosis information included on claims is intended to justify payment. Therefore, diagnosis data on claims may suffer from bias or limited detail.

- Commercial insurance does not cover all healthcare services and coverage differs by patient, plan, and insurer. Commercial insurance patients may utilize these services using a different payer, and thus these services are not captured in commercial insurance data.

- Patients may be insured by multiple insurers. Thus, even normally covered ophthalmology services may not be indicated in commercial insurance data if services were reimbursed by another payer.