|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

||||

| ||||||||||

|

|

|

|

|

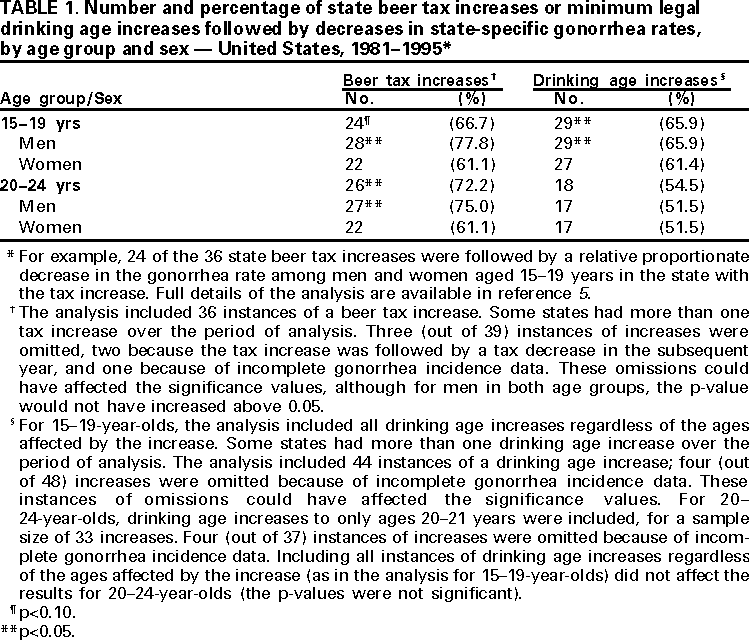

Persons using assistive technology might not be able to fully access information in this file. For assistance, please send e-mail to: mmwrq@cdc.gov. Type 508 Accommodation and the title of the report in the subject line of e-mail. Alcohol Policy and Sexually Transmitted Disease Rates --- United States, 1981--1995In the United States, adolescents and young adults are at higher risk for acquiring sexually transmitted diseases (STDs) than older adults (1). In addition, young persons who drink alcohol may be more likely than persons who abstain to participate in high-risk sexual activity, such as unprotected sexual intercourse or multiple sexual partners (2). If alcohol consumption promotes risky sexual behavior (disinhibition caused by the effects of alcohol), state government alcohol policies, such as alcohol taxation and minimum legal drinking age requirements, might reduce STD incidence among adolescents and young adults. Higher alcohol taxes and increases in the minimum legal drinking age have been associated with lower incidences of adverse alcohol-related health outcomes (e.g., motor-vehicle crash-related deaths, liver cirrhosis, suicide, and violent crime, including domestic violence) (3,4). This report summarizes the findings of a study (5) that suggest higher alcohol taxes and higher minimum legal drinking ages are associated with lower STD incidence among certain age groups. The study examined the association between crude gonorrhea incidence (new cases per 100,000 population) and alcohol policy indicators (alcohol taxation and drinking age requirements) in the 50 states and the District of Columbia during 1981--1995. Alcohol policy data were obtained from the Distilled Spirits Council of the United States (6,7), and gonorrhea incidence data were collected by CDC through surveillance systems in each state (1). The relation between alcohol policy and gonorrhea rates was established using a quasi-experimental analysis of a state's gonorrhea rate during the year before and after a change was made in the state alcohol policy indicators and a multivariate regression analysis between state gonorrhea rates and state alcohol policy indicators. The quasi-experimental analysis compared changes in gonorrhea rates in states with a beer tax increase (experimental states) with changes in gonorrhea rates in states without a beer tax increase (control states). An experimental state had a relative decrease in its gonorrhea rate if the decrease was greater (in percentage) than the median of the control states. To test the null hypothesis that beer tax increases had no effect on gonorrhea rates, p-values were calculated as two-tailed tests from the binomial distribution under the null hypothesis that each change in the gonorrhea rate in experimental states would have a 0.50 probability of being a relative decrease. A quasi-experimental analysis of drinking age increases also was conducted. In the regression analysis, the dependent variable was the state-specific gonorrhea rate, and the alcohol policy indicators were independent variables. The model included variables for each state and each year to control for state-specific differences in gonorrhea incidence and trends in gonorrhea incidence common to all states. To further control the models for omitted and/or unobservable factors (e.g., state-level demographic characteristics and STD-prevention activities) related to state-specific STD rates and trends, the model included the state's gonorrhea rate during the previous year as an independent variable. Most beer tax increases were followed by a relative proportionate decrease in gonorrhea rates among young adults (24 [66.7%] of 36 instances of beer tax increases among 15--19-year-olds [p<0.10] and 26 [72.2%] of 36 instances among 20--24-year-olds [p<0.05]) (Table 1). In both age groups, this relation was greater for gonorrhea rates among men than women. Most minimum legal drinking age increases were followed by a relative proportionate decrease in the gonorrhea rate, and this majority was statistically significant among 15--19-year-olds (29 [65.9%] of 44 instances of minimum legal drinking age increases) but not among 20--24-year-olds (18 [54.5%] of 33 instances). Regression analysis also showed that higher beer taxes were associated with lower gonorrhea rates among young adults in both age groups, and that minimum legal drinking age increases were associated with lower gonorrhea rates among 15--19-year-olds. The regression analysis suggested that a beer tax increase of $0.20 per six-pack could reduce overall gonorrhea rates by 8.9%. Reported by: P Harrison, PhD, Brandeis Univ, Waltham, Massachusetts. WJ Kassler, MD, New Hampshire Dept of Health and Human Svcs. Div of Sexually Transmitted Diseases Prevention, National Center for HIV, STD, and TB Prevention, CDC. Editorial Note:The findings in this report indicate that more restrictive state alcohol policies are associated with lower gonorrhea rates among certain age groups. The two methods of analysis yielded similar results and were consistent under a wide range of robustness checks and alternative model specifications (5). The results of this study are consistent with a study that higher minimum legal drinking ages were associated with decreases in childbearing rates among teenagers (8). The findings in this report are subject to at least two limitations. First, because state gonorrhea reporting practices vary, state-specific gonorrhea rates should be compared with caution. Second, the analysis may be subject to confounding effects of unobservable factors (e.g., community norms regarding alcohol consumption and sexual behavior or dramatic shifts in state-specific STD rates); omitting these variables could cause substantial bias when comparing across states the association between alcohol policy indicators and alcohol-related health outcomes (9,10). Given these limitations, the study findings, particularly the temporal relation between higher alcohol taxes and a decline in gonorrhea rates, are consistent with but do not prove a causal relation between higher taxes and declining STD rates. The postulated causal relation is based on the assumptions that higher alcohol taxes and a higher minimum legal drinking age can reduce alcohol consumption, and that reduced alcohol consumption can reduce participation in risky sexual behavior. With few exceptions (2,9,10), most studies have demonstrated that alcohol consumption declines after alcohol tax increases (3,5) and have detected an association between risky sexual behavior and alcohol or drug use (2). Reducing alcohol use and risky sexual behavior among young persons are two national health objectives for 2010 (4). Higher alcohol prices and improved enforcement of minimum legal drinking age requirements have been highlighted as potential strategies to reduce alcohol consumption by youth (4). Alcohol policy also could be used to reduce risky sexual behavior and its adverse medical and social consequences. Additional research is needed to continue examining the relation between alcohol policy and risky sexual behavior. References

Table 1  Return to top. Disclaimer All MMWR HTML versions of articles are electronic conversions from ASCII text into HTML. This conversion may have resulted in character translation or format errors in the HTML version. Users should not rely on this HTML document, but are referred to the electronic PDF version and/or the original MMWR paper copy for the official text, figures, and tables. An original paper copy of this issue can be obtained from the Superintendent of Documents, U.S. Government Printing Office (GPO), Washington, DC 20402-9371; telephone: (202) 512-1800. Contact GPO for current prices. **Questions or messages regarding errors in formatting should be addressed to mmwrq@cdc.gov.Page converted: 4/27/2000 |

|||||||||

This page last reviewed 5/2/01

|